In this article, we’ll answer your questions about taxes in Luxembourg.

Tax in Luxembourg

We receive many questions about tax in Luxembourg. The most frequent question is, “Will I have to pay taxes in Luxembourg as a dual citizen?” Below, we will explore this question, among others.

First, we want to be clear that this is not tax advice. This article should be used as a general guideline. For information on your personal situation, you should contact a tax professional.

Who Pays Tax in Luxembourg?

First, many United States citizens know that the IRS taxes your global income. However, this is a unique phenomenon in the USA. The United States and Eritrea are the only countries in the world with citizenship-based taxation.

So, how does it work in Luxembourg? Tax in Luxembourg is imposed on the worldwide income of individuals physically residing in Luxembourg. Luxembourg also taxes Luxembourg-source income of non-residents. Even if you are a citizen of Luxembourg, you are a non-resident if you don’t currently live in Luxembourg. So, if you are a Luxembourg dual citizen living in the USA who does not make any money in Luxembourg, there are no tax implications for you.

I Have No Luxembourg Income

If you are a Luxembourg dual citizen with no source income in Luxembourg, you have no action to take related to taxes. There is no need to file an annual informational return in Luxembourg. You do not need to declare in any way your global earnings. At no time do you need to interact with the tax authorities in Luxembourg.

I Have Luxembourg Source Income

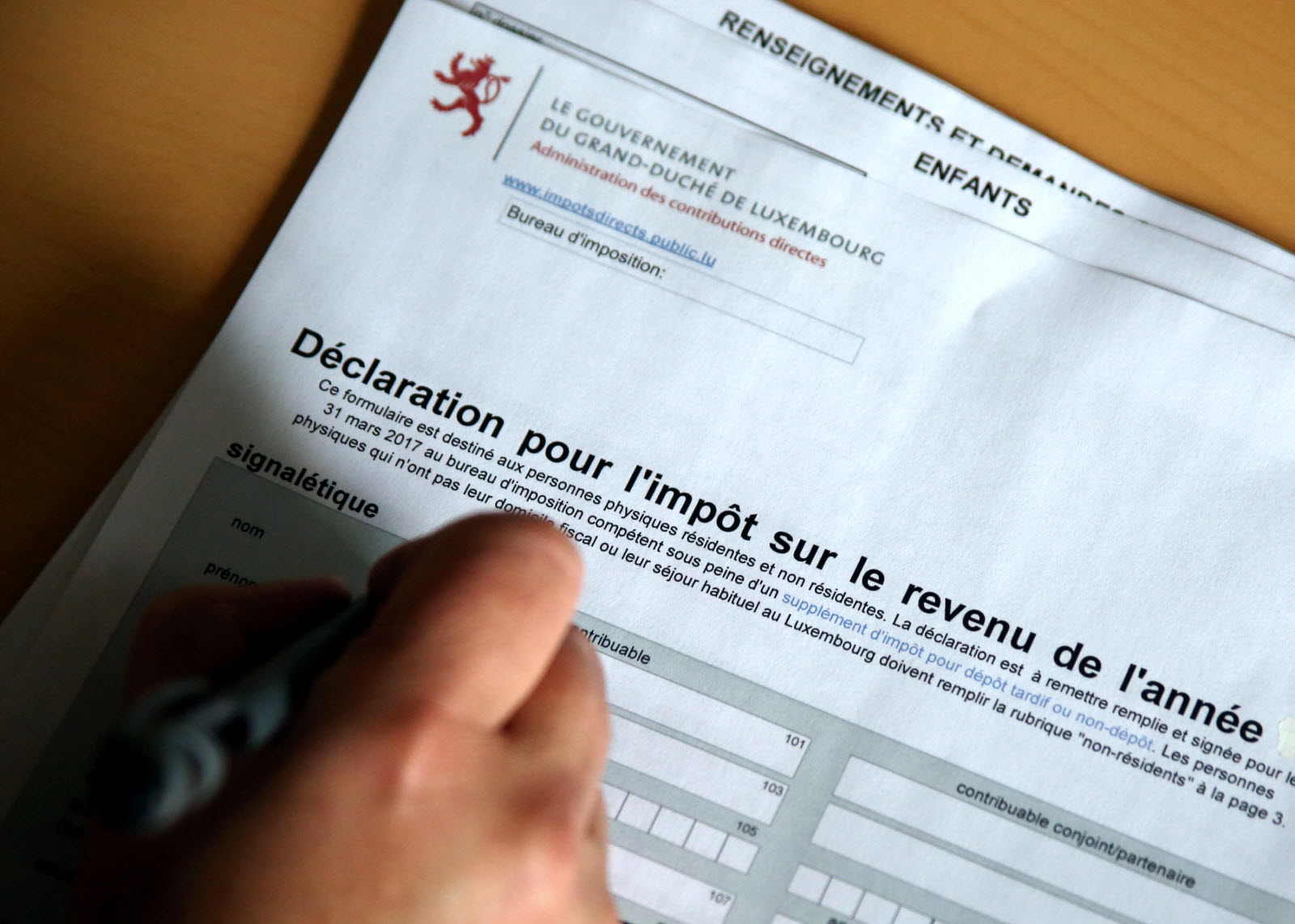

Considering a move to Luxembourg or already a Luxembourg resident? If you take up a job in Luxembourg, taxes will be withheld at source on employment income. If you make below a certain threshold, you may not need to file an annual return. Your company will process this information for you. If you still have income sources in the USA like rental income, you will have to declare that and may have to pay income on that in Luxembourg. You will need to have a tax return prepared.

Considering a move to Luxembourg or already a Luxembourg resident? If you take up a job in Luxembourg, taxes will be withheld at source on employment income. If you make below a certain threshold, you may not need to file an annual return. Your company will process this information for you. If you still have income sources in the USA like rental income, you will have to declare that and may have to pay income on that in Luxembourg. You will need to have a tax return prepared.

Practical Information

The tax year in Luxembourg is from January 1 to December 31st. Tax returns are due in normal years on March 31st for the preceding year (i.e.: March 31, 2020, for tax year 2019). Because of the coronavirus, there are special exemptions and automatic deadline extensions in place for 2020.

The following types of earnings are subject to income tax in Luxembourg:

- Net income from employment or self-employment;

- Commercial or business profits;

- Profits from agriculture and forestry;

- Net income from pensions and/or annuities (tax on any monthly pension income);

- Income from investments;

- Net income from the rental of property;

- Other net income (including capital gains)

Luxembourg has three tax classes:

- #1 for single persons.

- #2 for married persons as well as civil partners (under certain conditions).

- #1a for single persons with children as well as single taxpayers aged at least 65 on 1 January of the tax year.

Here are the brackets provided by Expatica.com:

| From | To | % |

| €0 | €11,265 | 0% |

| €11,266 | €13,173 | 8% |

| €13,137 | €15,009 | 9% |

| €15,009 | €16,881 | 10% |

| €16,881 | €18,753 | 11% |

| €18,753 | €20,625 | 12% |

| €20,625 | €22,569 | 14% |

| €22,569 | €24,513 | 16% |

| €24,513 | €26,457 | 18% |

| €26,457 | €28,401 | 20% |

| €28,401 | €30,345 | 22% |

| €30,345 | €32,289 | 24% |

| €32,289 | €34,233 | 26% |

| €34,233 | €36,177 | 28% |

| €36,177 | €38,121 | 30% |

| €38,121 | €40,065 | 32% |

| €40,065 | €42,009 | 34% |

| €42,009 | €43,953 | 36% |

| €43,953 | €45,897 | 38% |

| €45,897 | €100,002 | 39% |

| €100,002 | €150,000 | 40% |

| €150,000 | €200,004 | 41% |

| €200,004+ | 42% |

Property Taxes

Property Taxes

There are other taxes in Luxembourg, as well as income tax. The most common other taxes relate to property. Generally speaking, the price per square footage for property in Luxembourg is very high. However, taxes are very low. Total taxes on the sale of property amount to around 7%. Annual ground taxes range from 0.7-1.1% of the property’s value. This rate depends on the municipality where the property is located.

Inheritance

We receive many questions regarding how inheritance goes in Luxembourg. You should understand that where inheritance is administered relates to where you maintain your primary domicile or where you have amassed your personal wealth. Inheritance in Luxembourg falls under two categories:

- the inheritance tax: the amount of tax due depends on the value of the assets of the estate of a Luxembourg resident (any person who has established their domicile or whose wealth is primarily located in Luxembourg);

- the transfer tax: transfer tax is levied on the value of immovable assets (property) in Luxembourg of a deceased person whose most recent domicile or wealth was not located in Luxembourg.

For direct lineage relatives (grandparents, parents, spouse, and children), inheritance and transfer tax are often close to zero.

More Information

Do you need more specific answers? We can get you in touch with a Luxembourg tax planner. Check out our contact page and get in touch.